Pocketpal Mobile App

Pocketpal Mobile App

A revolutionary budgeting and finance app to empower users to take control of their financial well-being

A revolutionary budgeting and finance app to empower users to take control of their financial well-being

Year

2023

Service

UI/UX Design

Category

Mobile App

Tool

Figma

General Overview

General Overview

General Overview

Pocketpal is a revolutionary budgeting and finance app designed to empower users to take control of their financial well-being. In today’s fast-paced world, managing finances can be overwhelming, but Pocketpal makes it simple and accessible for everyone. Whether you're just starting out on your financial journey or looking to optimize your existing budget, Pocketpal provides the tools and insights you need to make informed financial decisions.

Pocketpal is a revolutionary budgeting and finance app designed to empower users to take control of their financial well-being. In today’s fast-paced world, managing finances can be overwhelming, but Pocketpal makes it simple and accessible for everyone. Whether you're just starting out on your financial journey or looking to optimize your existing budget, Pocketpal provides the tools and insights you need to make informed financial decisions.

Pocketpal is a revolutionary budgeting and finance app designed to empower users to take control of their financial well-being. In today’s fast-paced world, managing finances can be overwhelming, but Pocketpal makes it simple and accessible for everyone. Whether you're just starting out on your financial journey or looking to optimize your existing budget, Pocketpal provides the tools and insights you need to make informed financial decisions.

Problem

Problem

Problem

Managing personal finances can be overwhelming due to a variety of challenges. Many individuals struggle with a lack of financial literacy, making it difficult to understand and manage their finances effectively. Inconsistent financial habits, such as difficulty in sticking to a budget or saving regularly, further complicate financial management. The complexity of tracking expenses and budgeting can be daunting, especially for those with multiple income sources or irregular earnings. Additionally, the burden of debt, inadequate savings, and poor investment planning contribute to financial stress. Concerns about data security and privacy often deter users from using digital financial management tools, exacerbating these issues.

Managing personal finances can be overwhelming due to a variety of challenges. Many individuals struggle with a lack of financial literacy, making it difficult to understand and manage their finances effectively. Inconsistent financial habits, such as difficulty in sticking to a budget or saving regularly, further complicate financial management. The complexity of tracking expenses and budgeting can be daunting, especially for those with multiple income sources or irregular earnings. Additionally, the burden of debt, inadequate savings, and poor investment planning contribute to financial stress. Concerns about data security and privacy often deter users from using digital financial management tools, exacerbating these issues.

Managing personal finances can be overwhelming due to a variety of challenges. Many individuals struggle with a lack of financial literacy, making it difficult to understand and manage their finances effectively. Inconsistent financial habits, such as difficulty in sticking to a budget or saving regularly, further complicate financial management. The complexity of tracking expenses and budgeting can be daunting, especially for those with multiple income sources or irregular earnings. Additionally, the burden of debt, inadequate savings, and poor investment planning contribute to financial stress. Concerns about data security and privacy often deter users from using digital financial management tools, exacerbating these issues.

Project Goals and Objectives

Project Goals and Objectives

Enable users to take full control of their financial lives by providing them with tools to manage their budgets, track expenses, and set realistic financial goals.

Enable users to take full control of their financial lives by providing them with tools to manage their budgets, track expenses, and set realistic financial goals.

Enable users to take full control of their financial lives by providing them with tools to manage their budgets, track expenses, and set realistic financial goals.

Focus on not just immediate financial needs but also long-term financial wellness by offering features that encourage users to save, invest, and plan for significant life events.

Focus on not just immediate financial needs but also long-term financial wellness by offering features that encourage users to save, invest, and plan for significant life events.

Focus on not just immediate financial needs but also long-term financial wellness by offering features that encourage users to save, invest, and plan for significant life events.

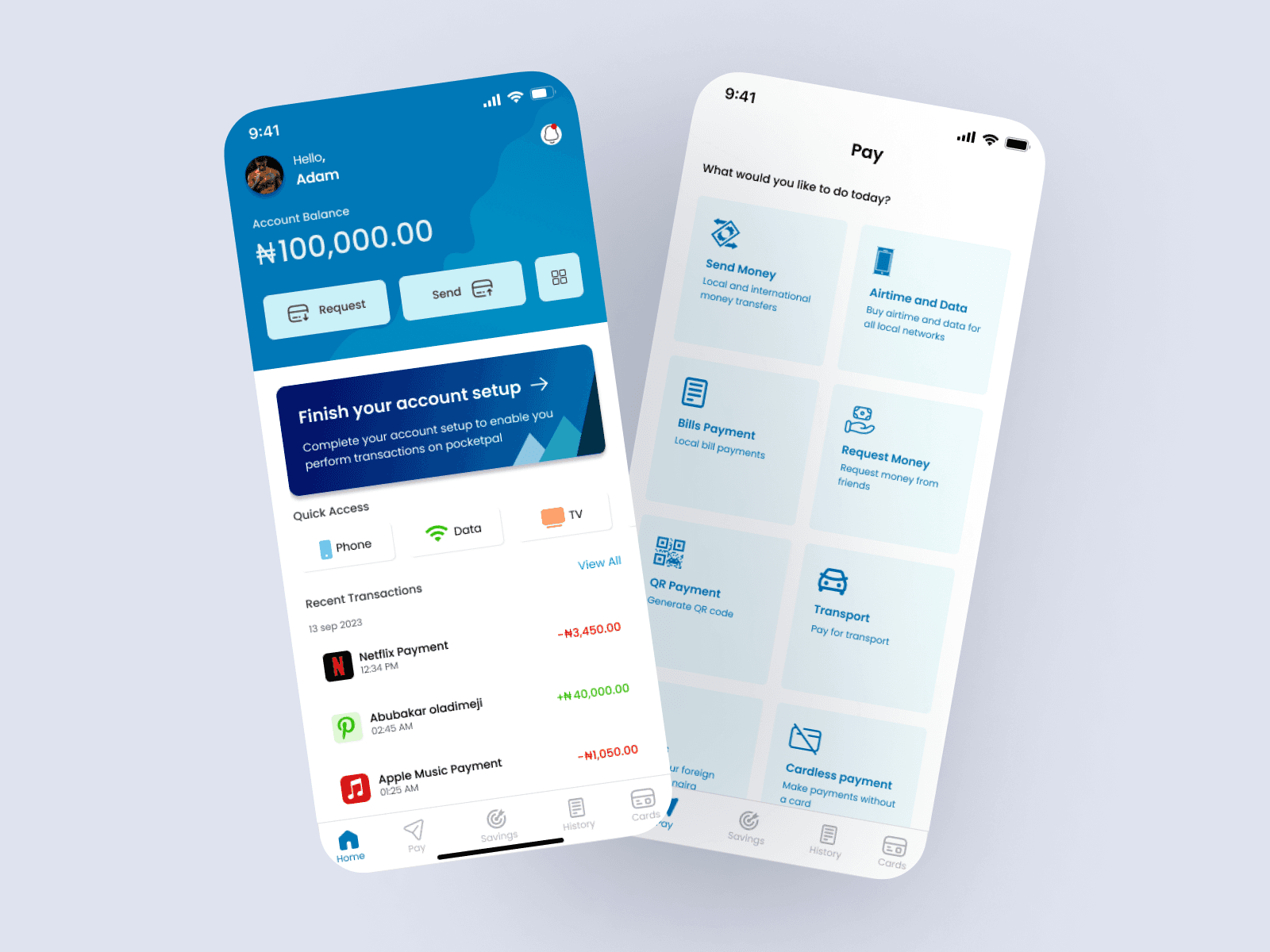

Develop and integrate a range of financial tools within the app, such as budget planners, expense trackers, savings goal calculators, and investment trackers.

Develop and integrate a range of financial tools within the app, such as budget planners, expense trackers, savings goal calculators, and investment trackers.

Develop and integrate a range of financial tools within the app, such as budget planners, expense trackers, savings goal calculators, and investment trackers.

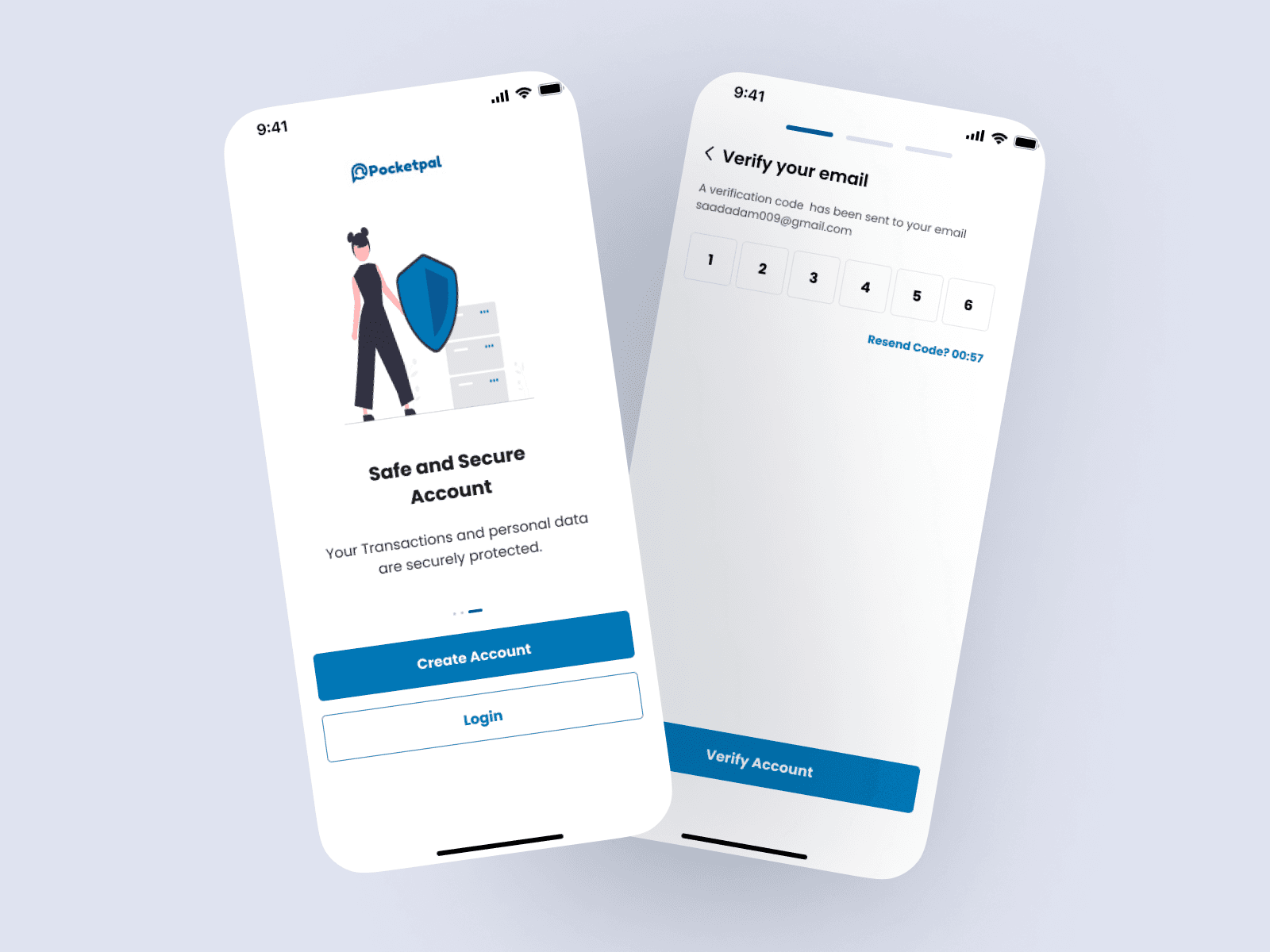

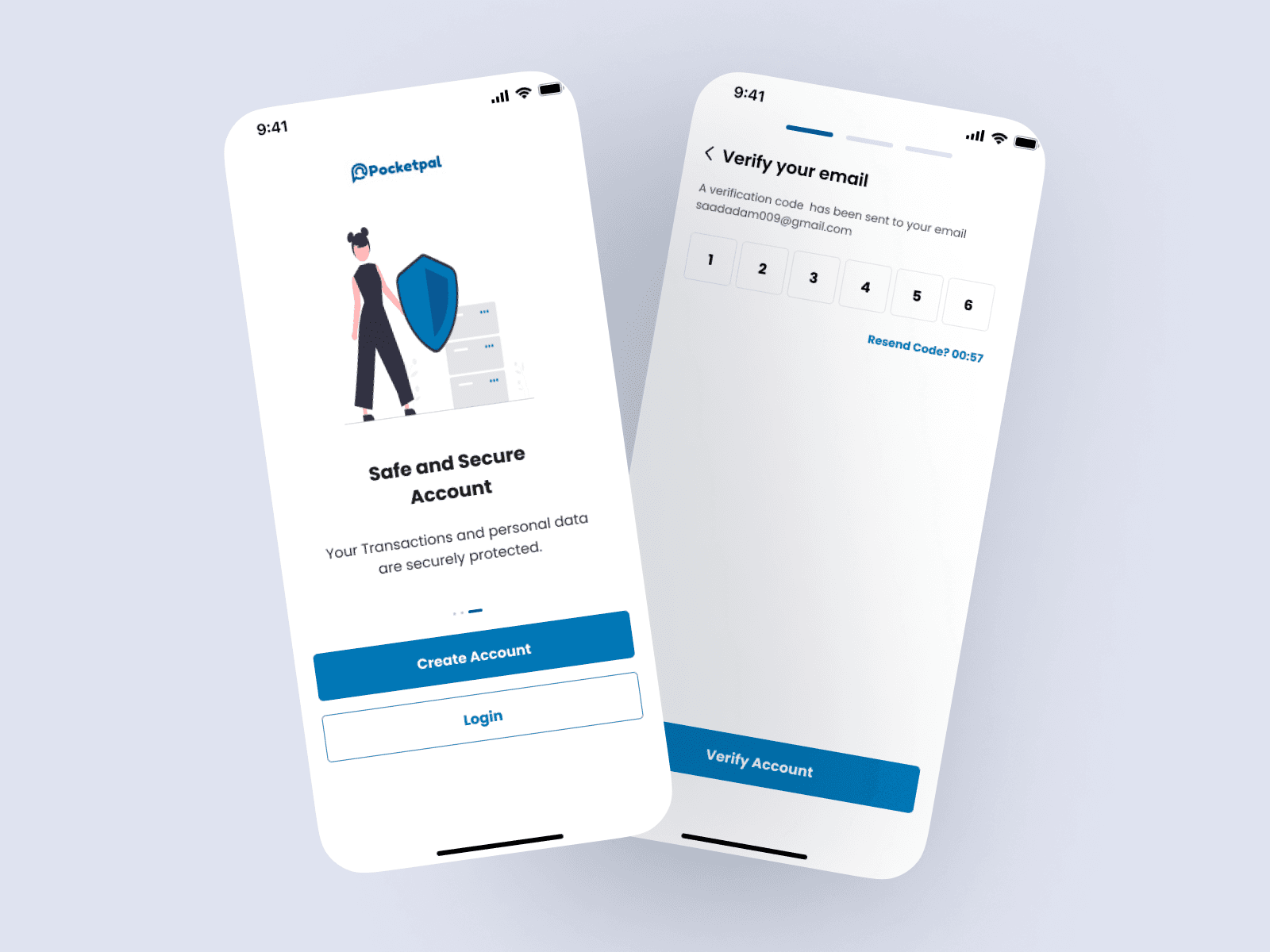

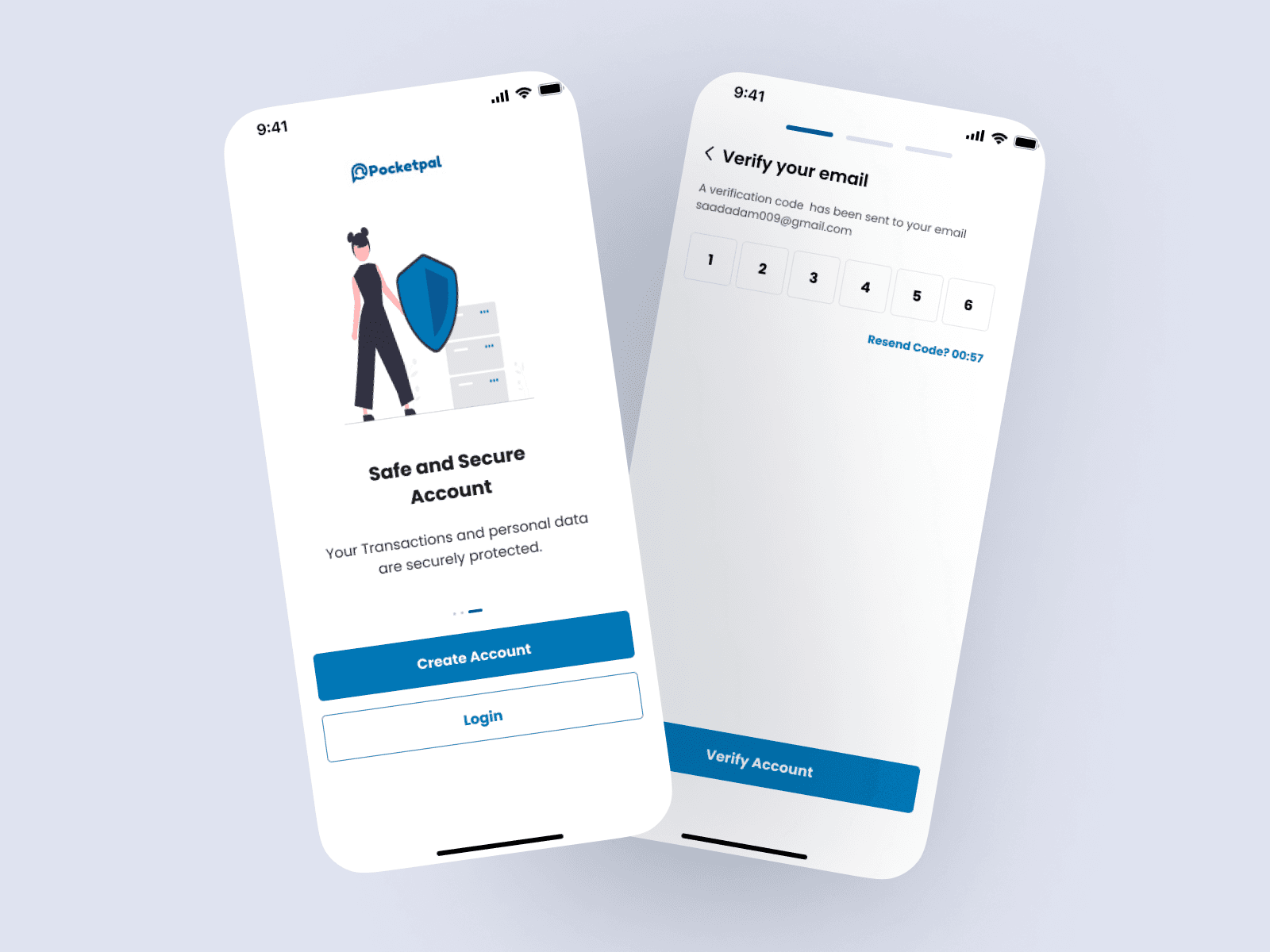

Prioritize the security and privacy of user data by implementing robust encryption and privacy measures.

Prioritize the security and privacy of user data by implementing robust encryption and privacy measures.

Prioritize the security and privacy of user data by implementing robust encryption and privacy measures.

Targeted Audience

Targeted Audience

Pocketpal is targeted towards young professionals and millennials navigating their financial independence, budget-conscious individuals managing daily expenses, and financial beginners looking for guidance. The app also supports busy professionals needing efficient tools, savvy savers and investors optimizing their strategies, debt managers working to reduce debt, freelancers with irregular incomes, and families managing household finances.

Pocketpal is targeted towards young professionals and millennials navigating their financial independence, budget-conscious individuals managing daily expenses, and financial beginners looking for guidance. The app also supports busy professionals needing efficient tools, savvy savers and investors optimizing their strategies, debt managers working to reduce debt, freelancers with irregular incomes, and families managing household finances.

The solution

The solution

Pocketpal addresses these financial challenges with a comprehensive set of solutions. It offers educational resources to enhance financial literacy and provides automated budgeting and expense tracking to simplify financial management. Users benefit from personalized financial insights and advice tailored to their specific needs, helping them improve their budgeting, saving, and investment strategies. For those struggling with debt, Pocketpal provides tools for creating and managing debt repayment plans. The app also supports users with irregular incomes through flexible budgeting features and offers guidance on setting and achieving savings goals. With a unified view of all financial accounts and robust security measures, Pocketpal ensures that users can manage their finances confidently and securely.

Pocketpal addresses these financial challenges with a comprehensive set of solutions. It offers educational resources to enhance financial literacy and provides automated budgeting and expense tracking to simplify financial management. Users benefit from personalized financial insights and advice tailored to their specific needs, helping them improve their budgeting, saving, and investment strategies. For those struggling with debt, Pocketpal provides tools for creating and managing debt repayment plans. The app also supports users with irregular incomes through flexible budgeting features and offers guidance on setting and achieving savings goals. With a unified view of all financial accounts and robust security measures, Pocketpal ensures that users can manage their finances confidently and securely.

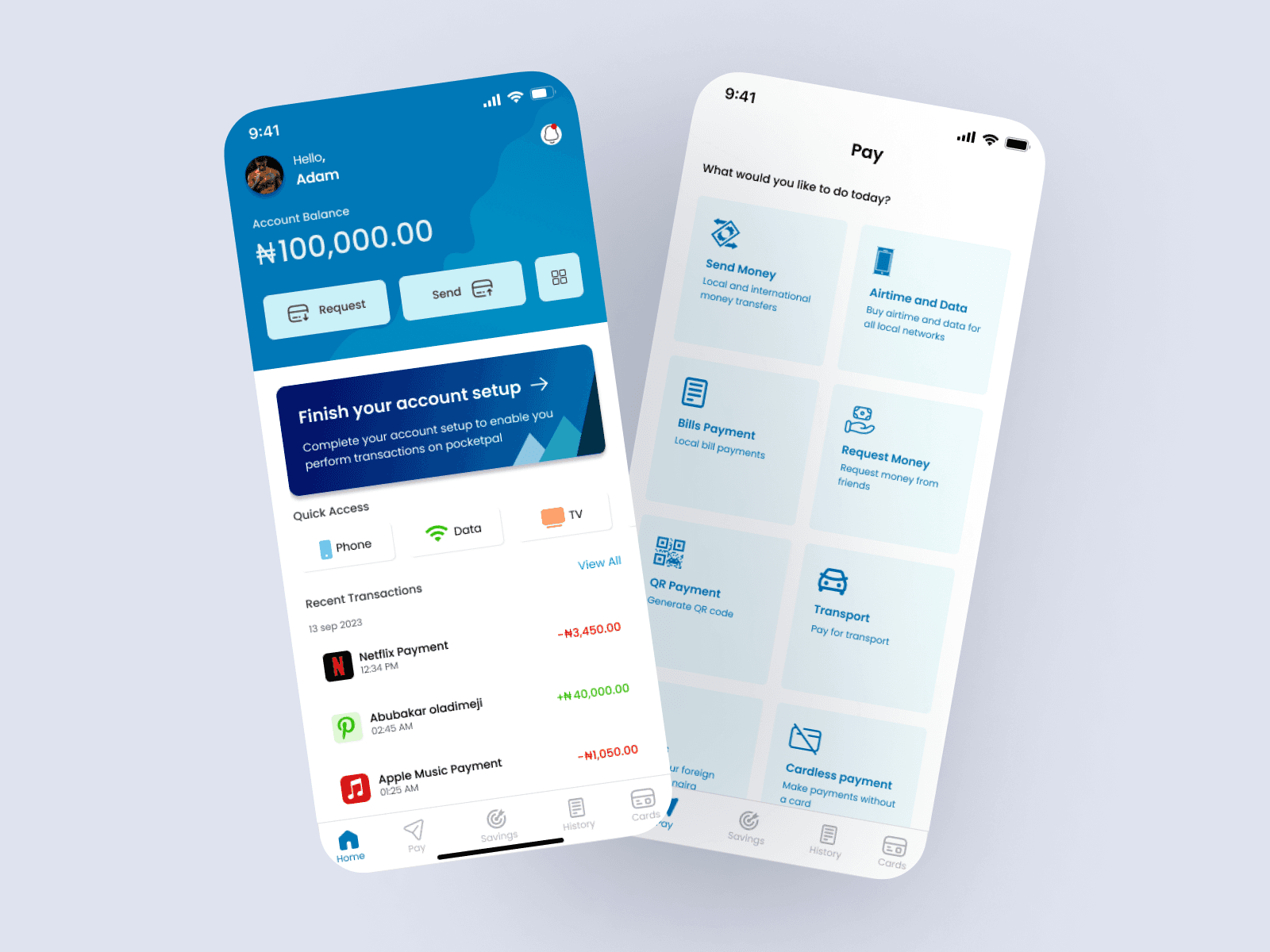

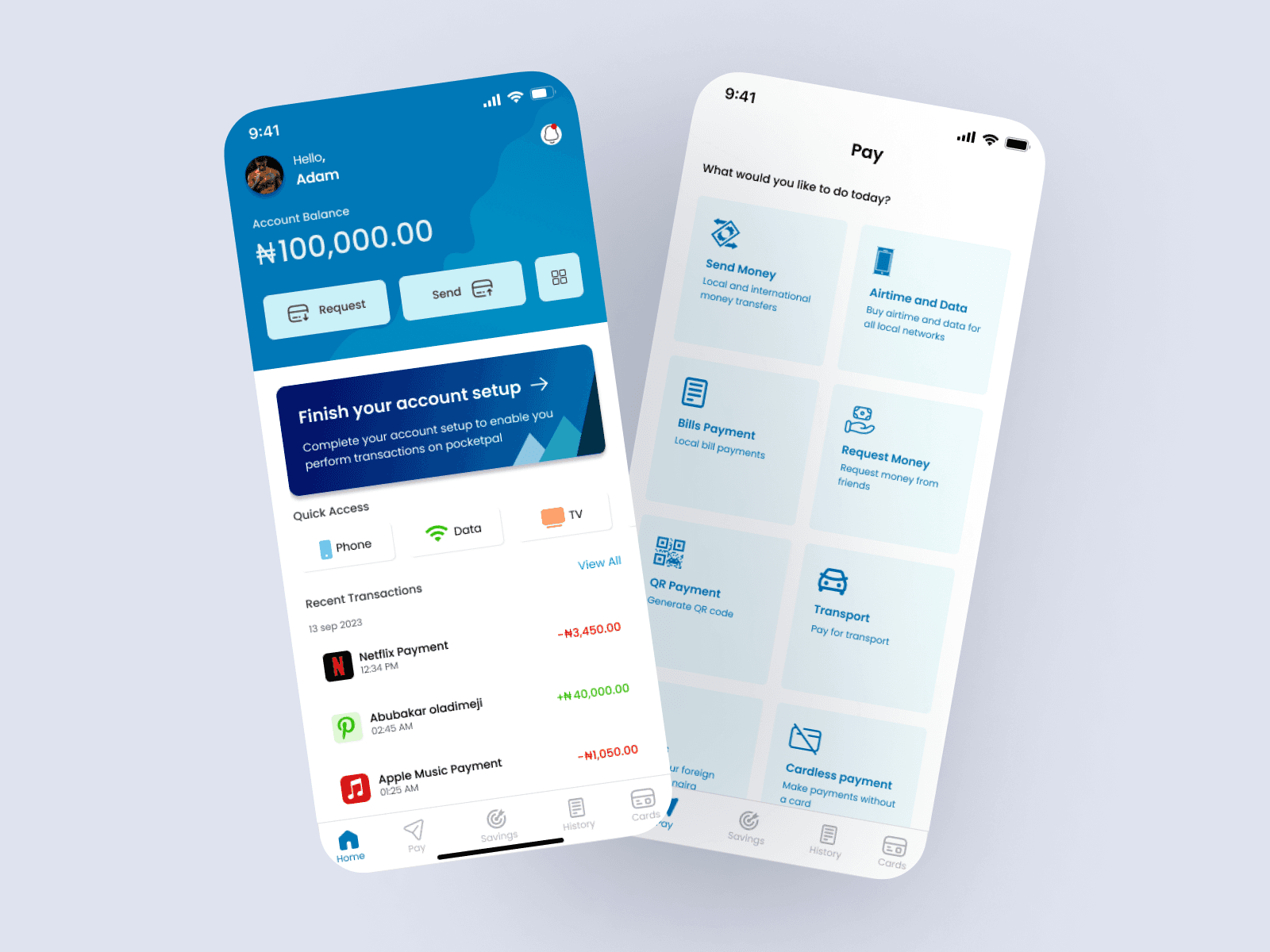

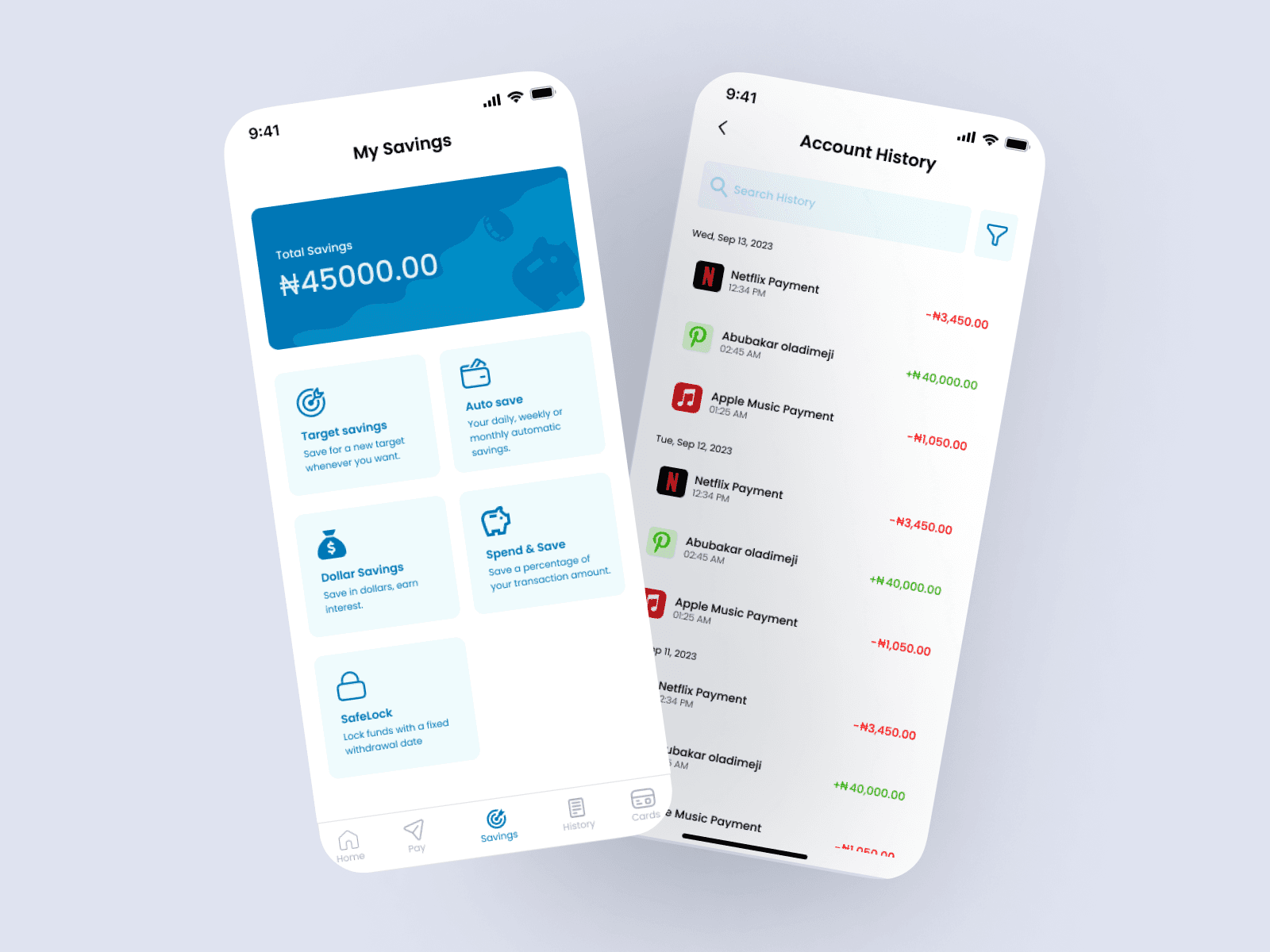

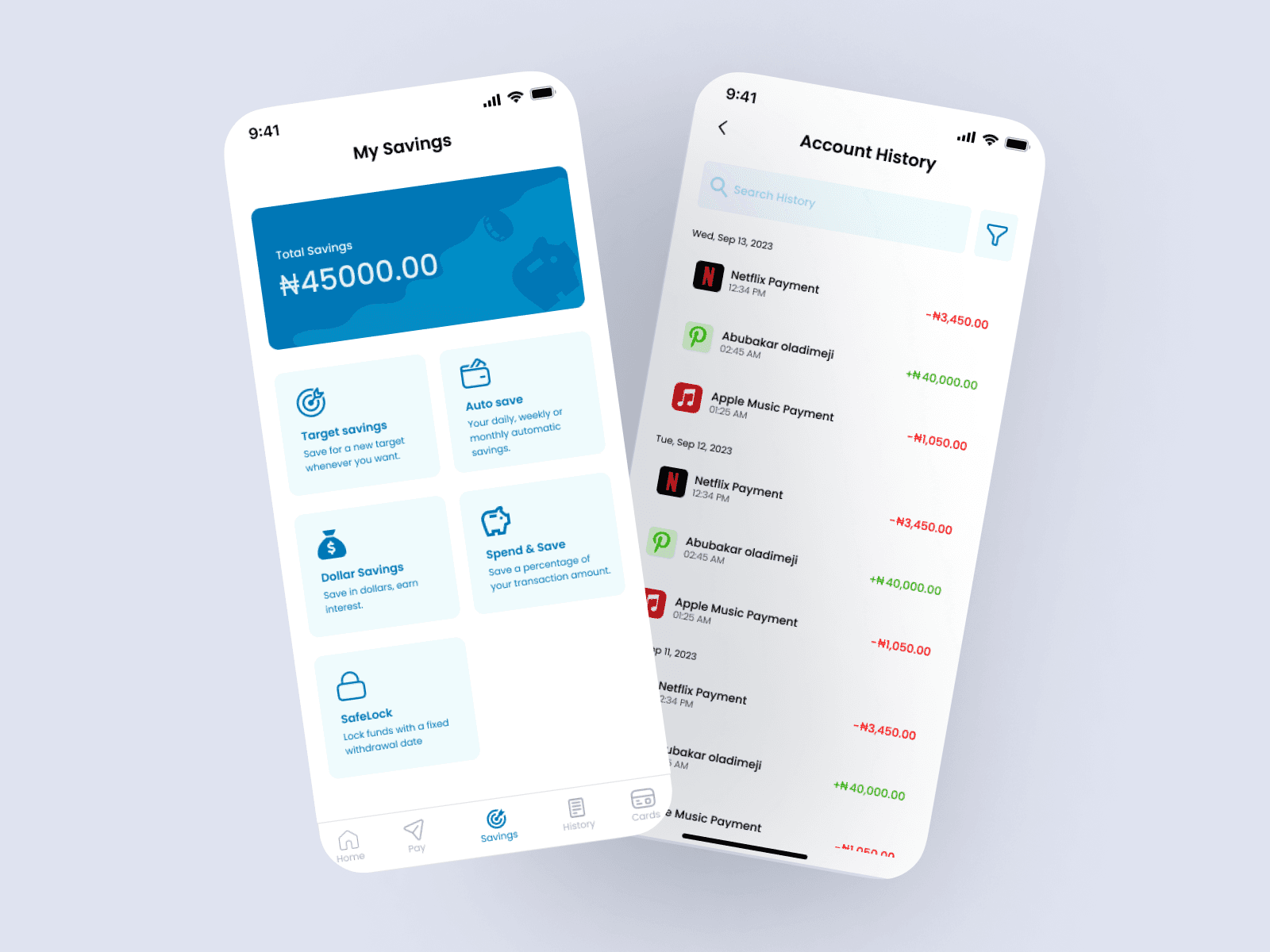

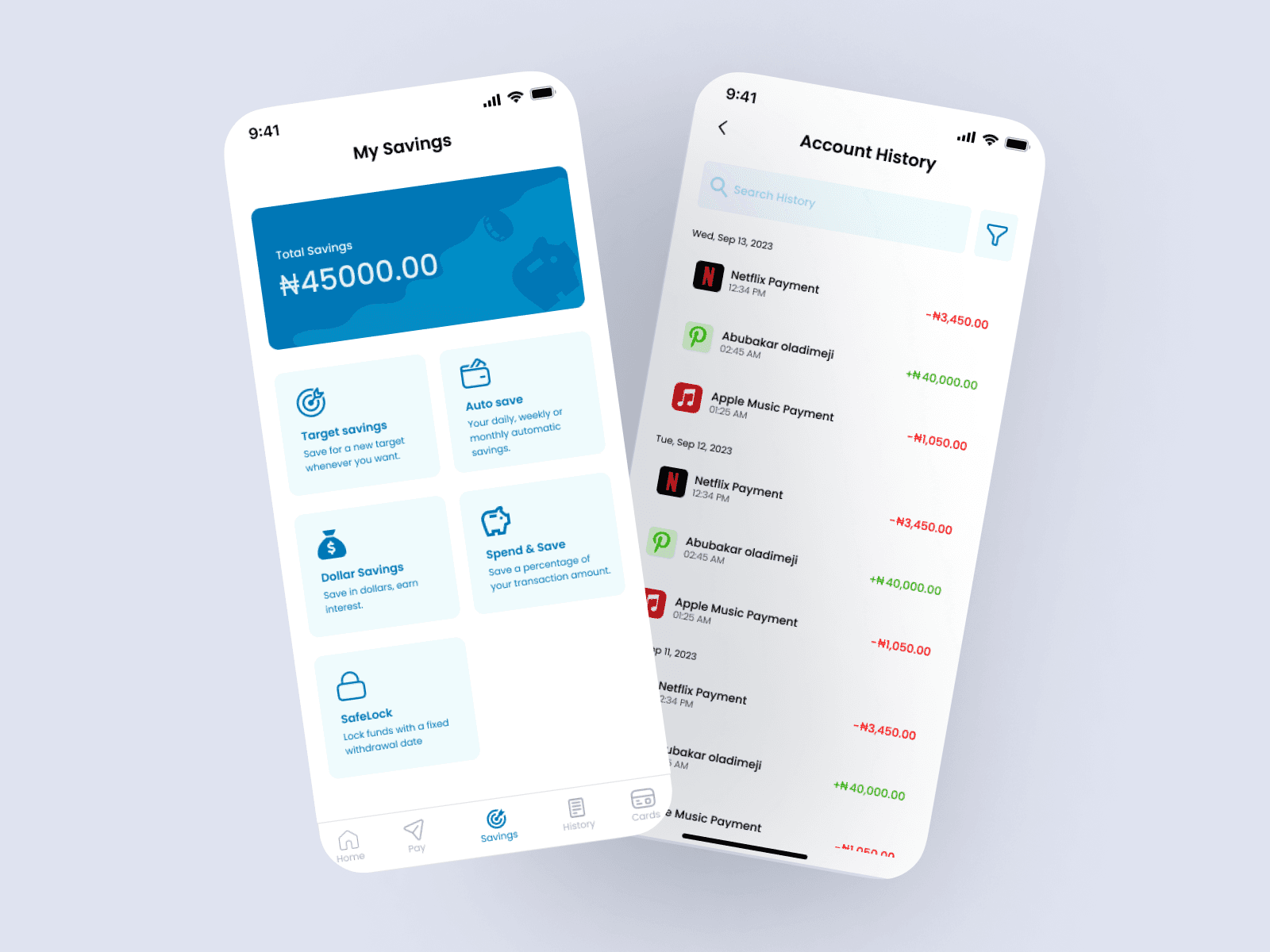

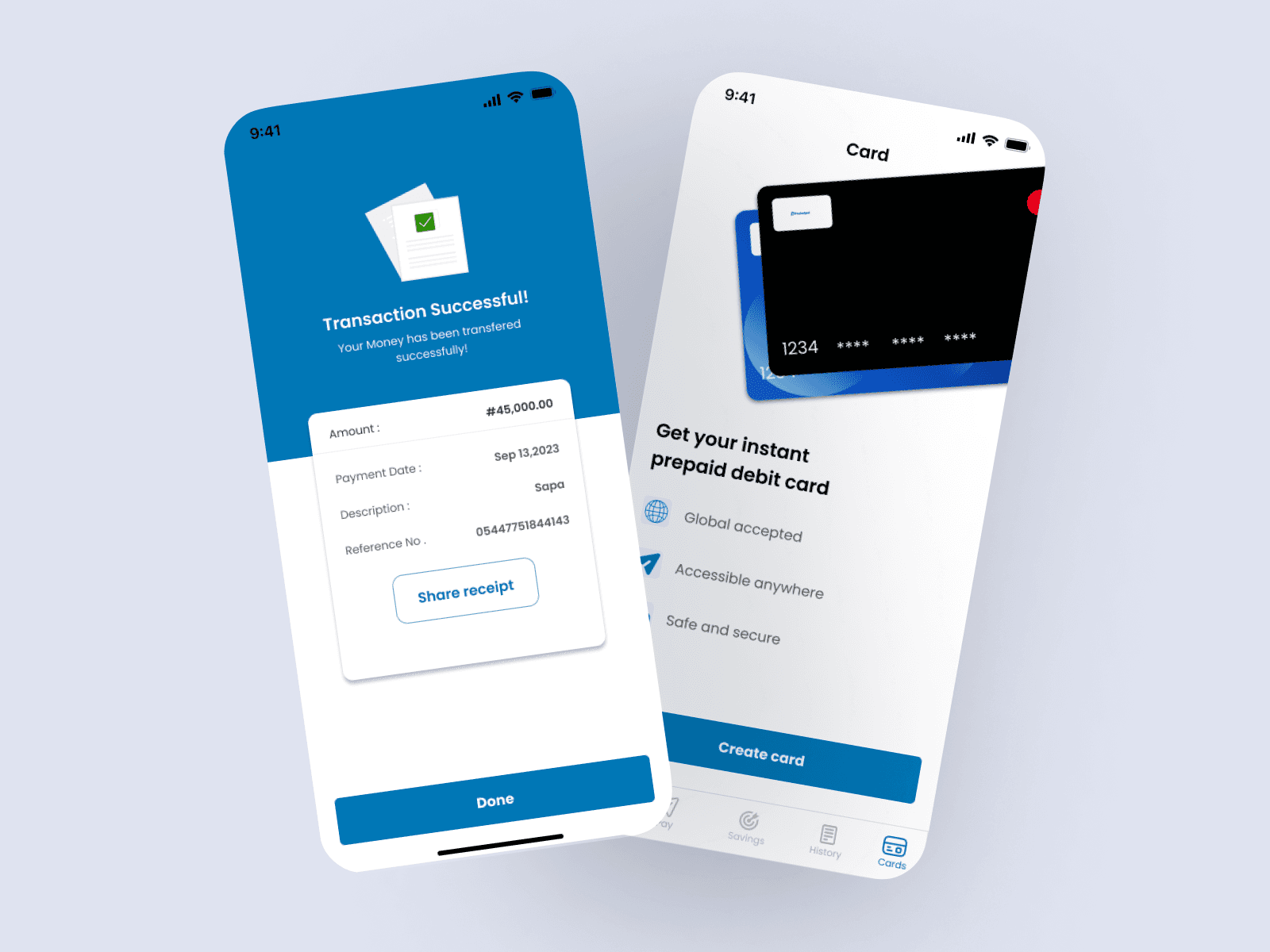

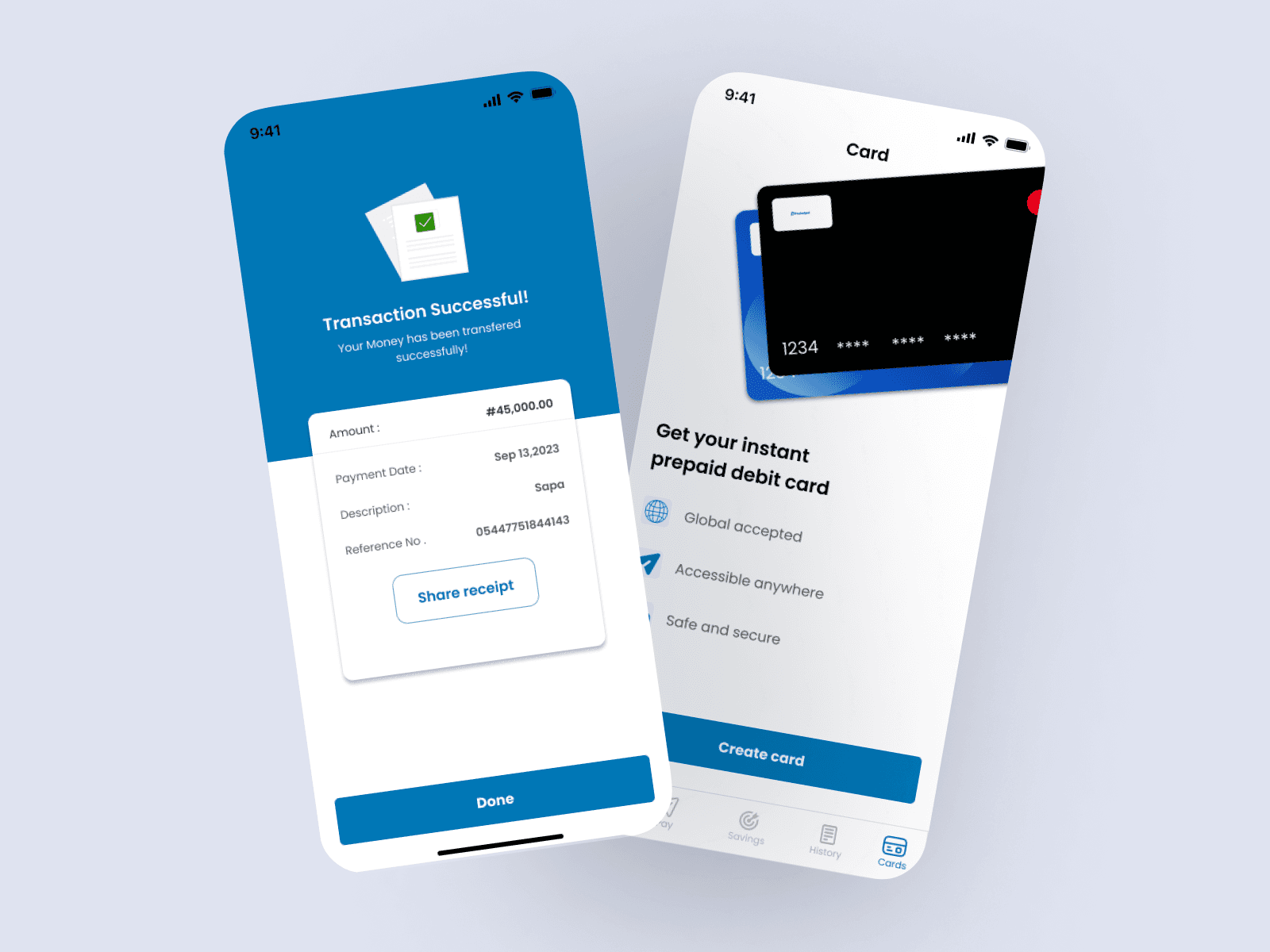

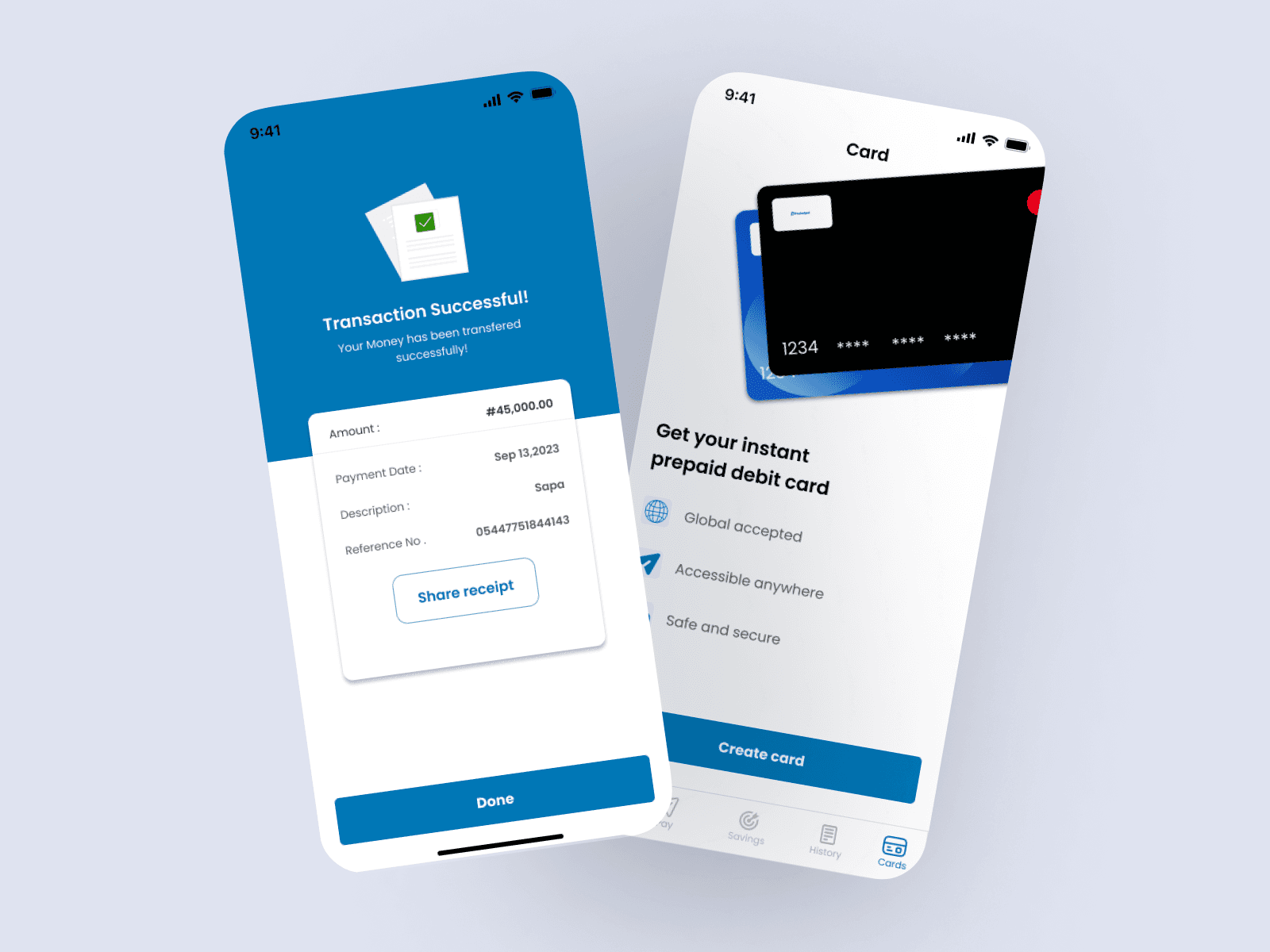

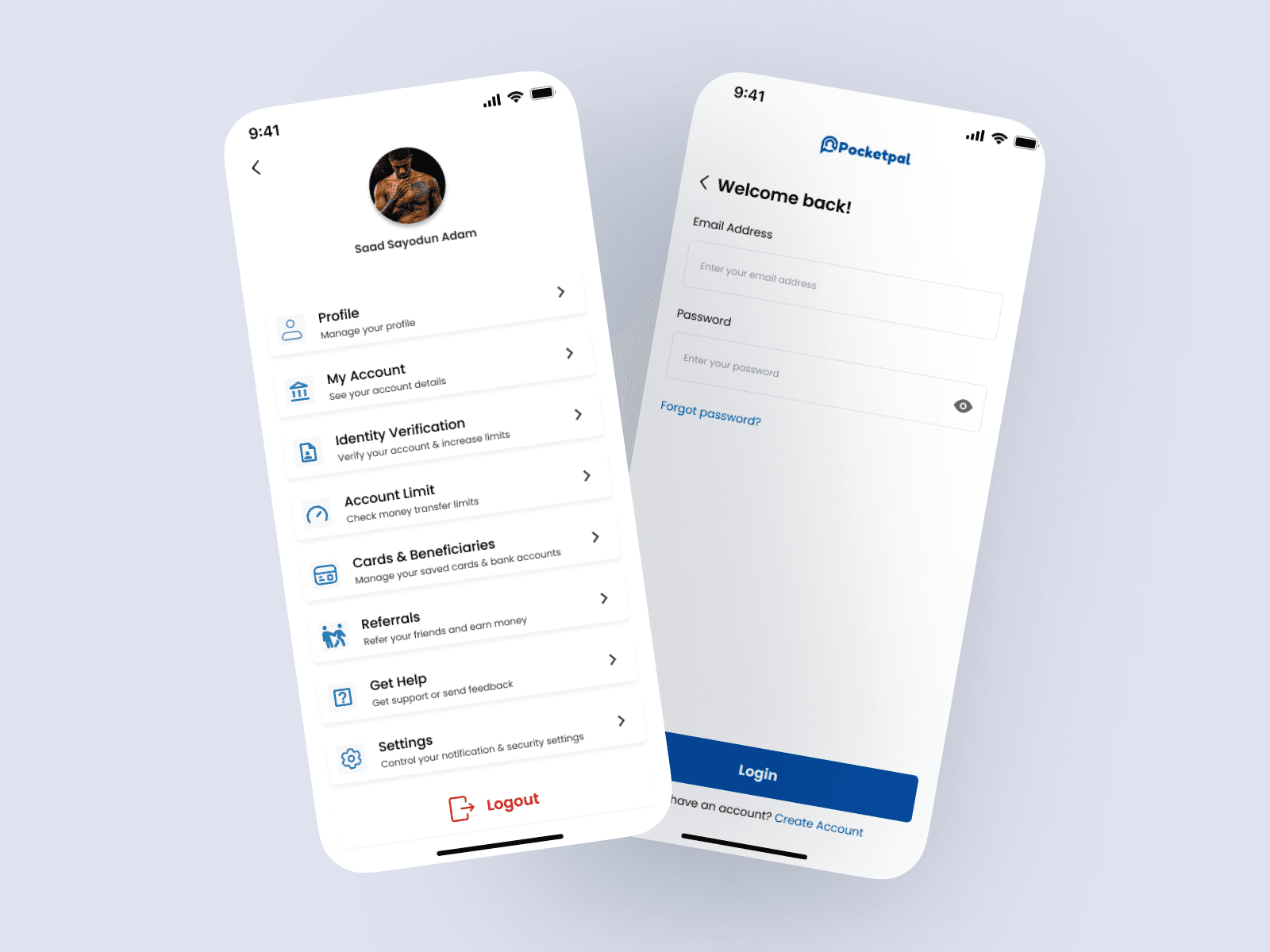

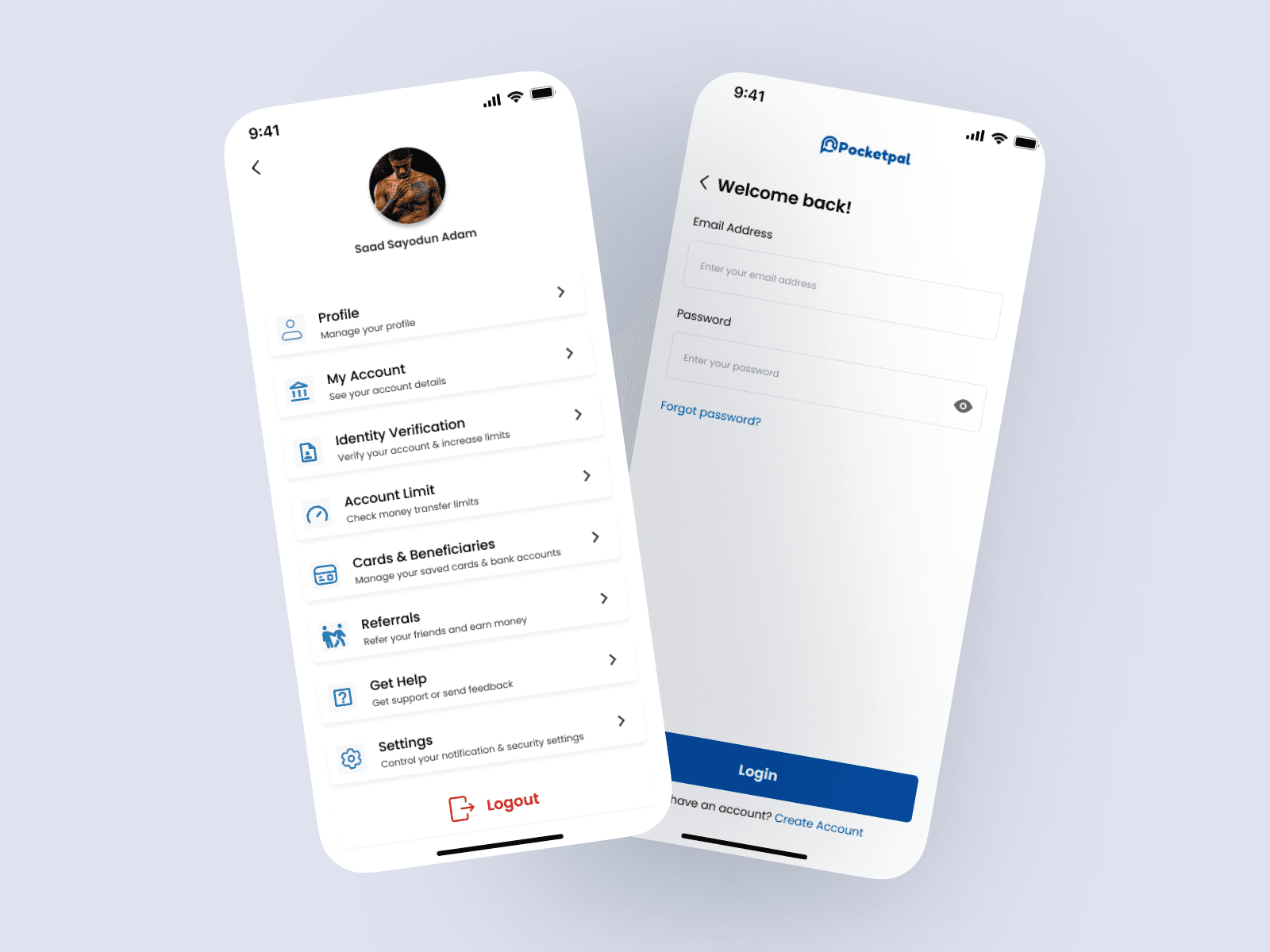

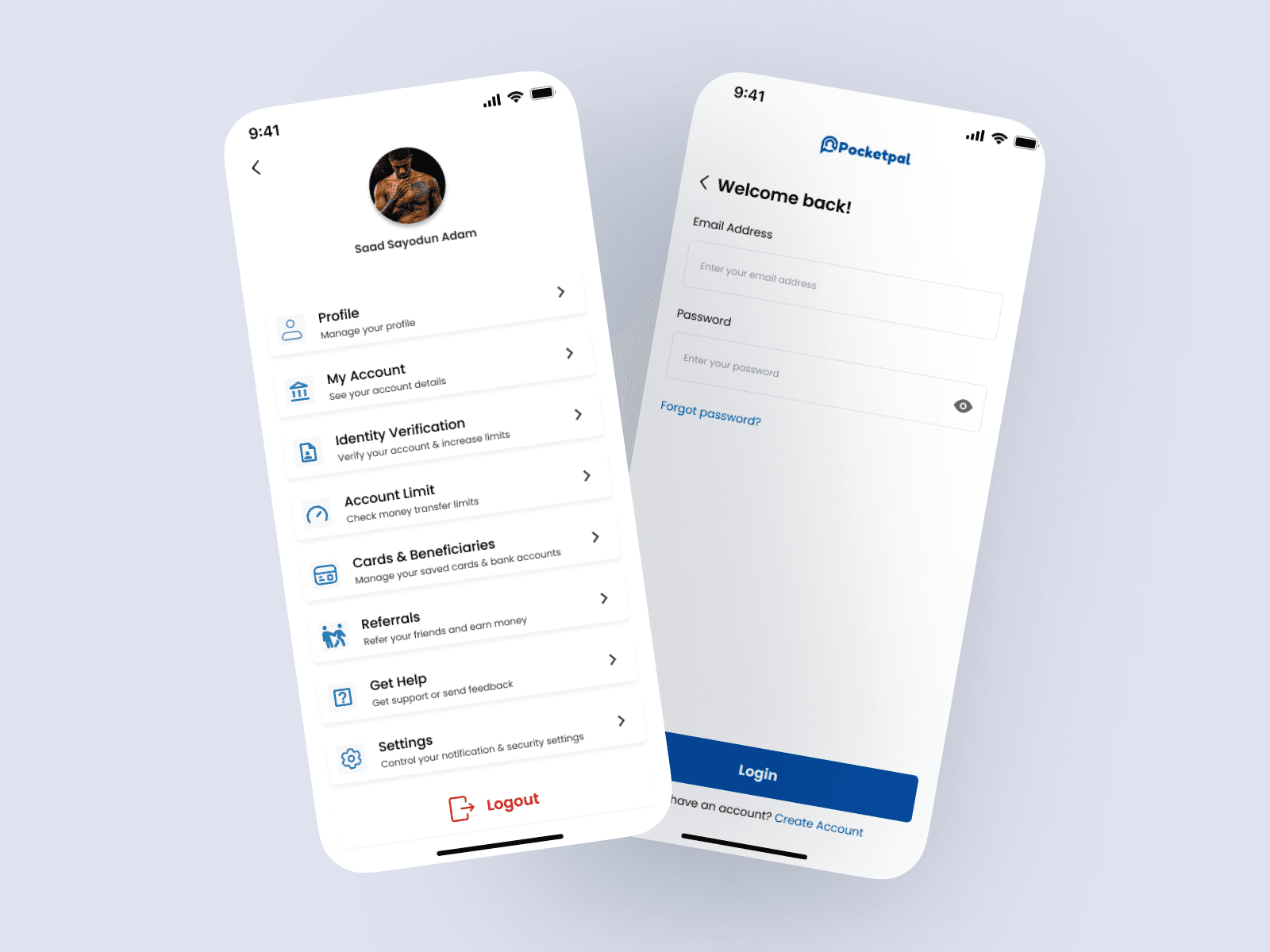

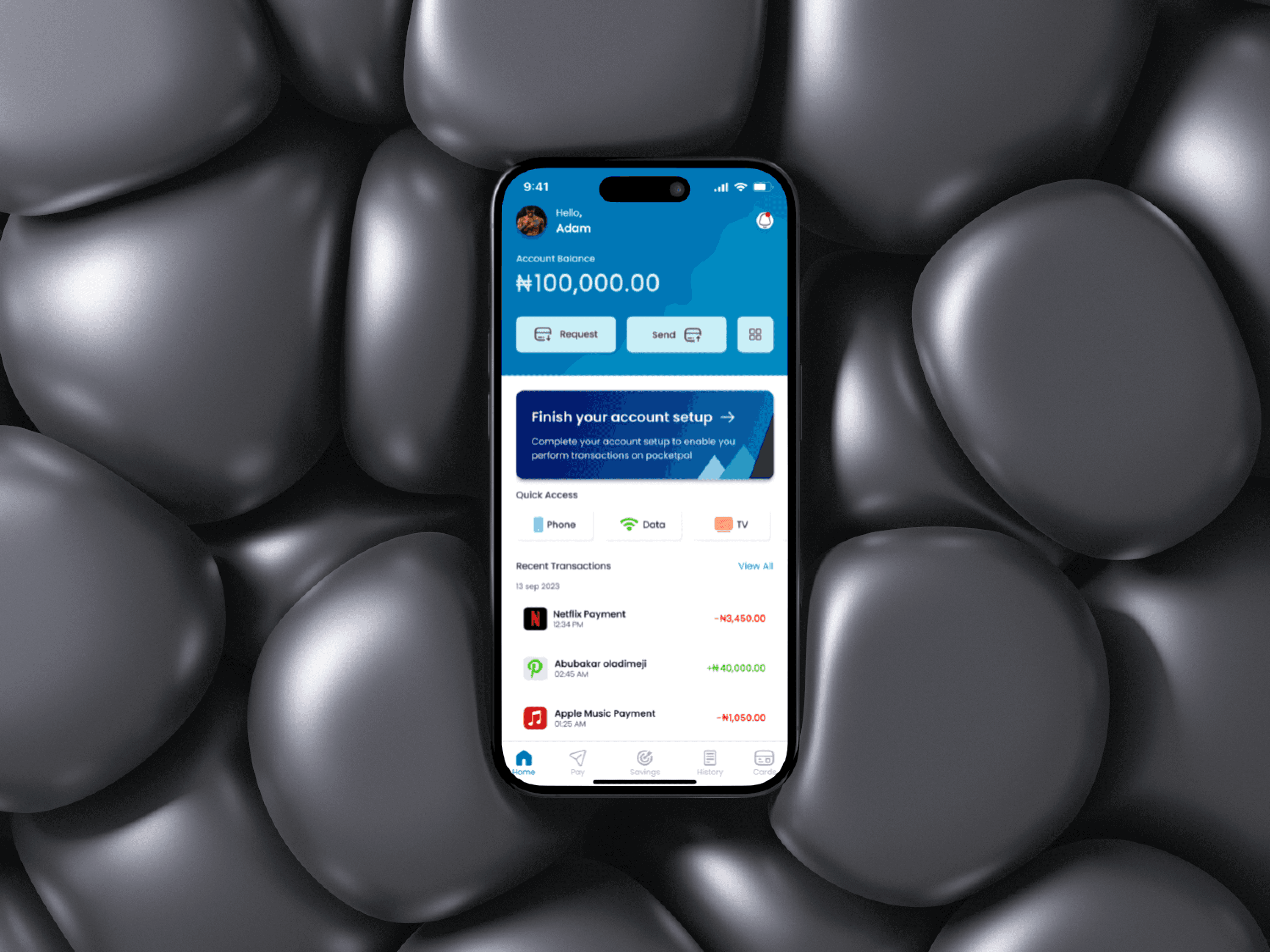

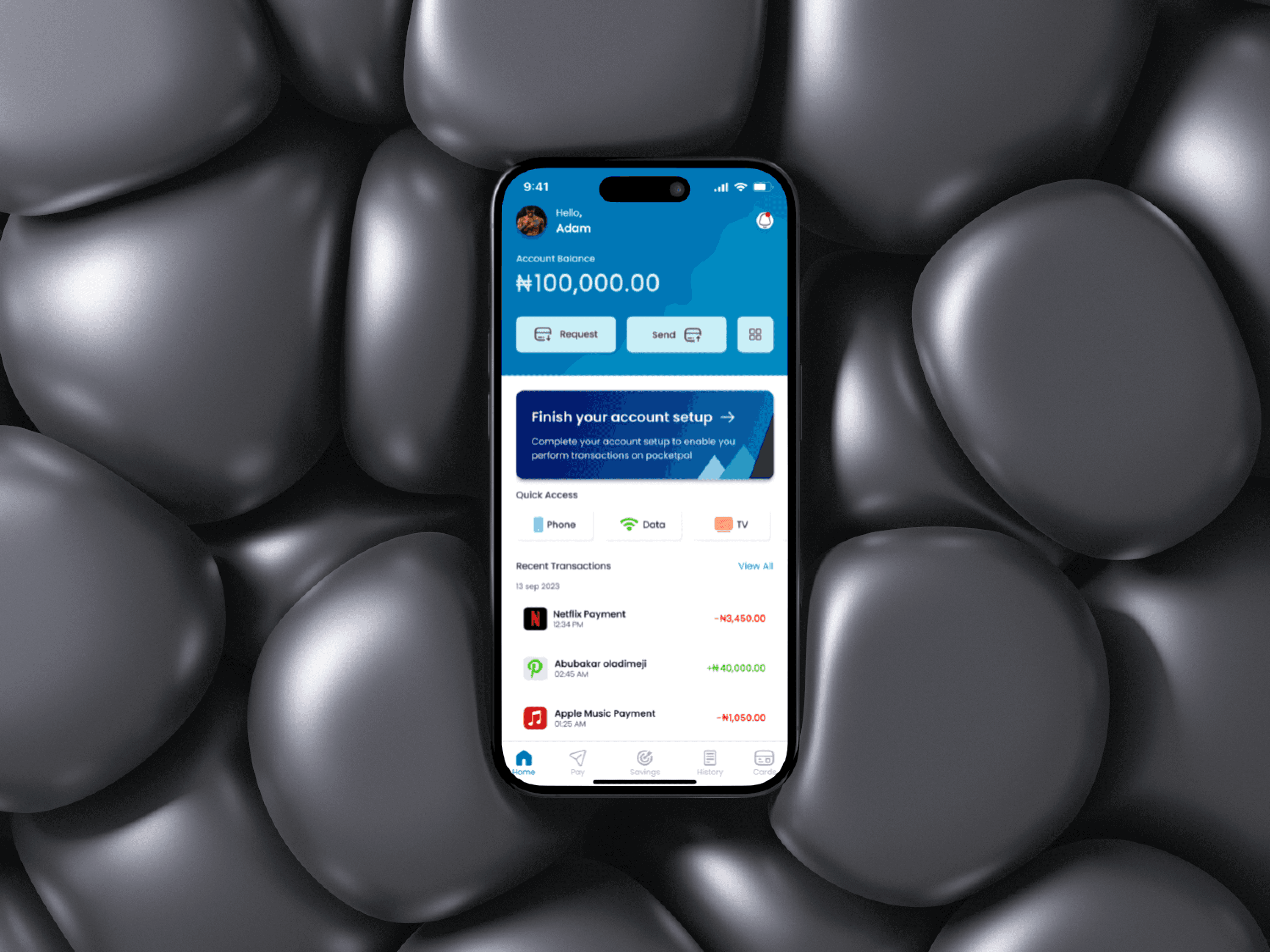

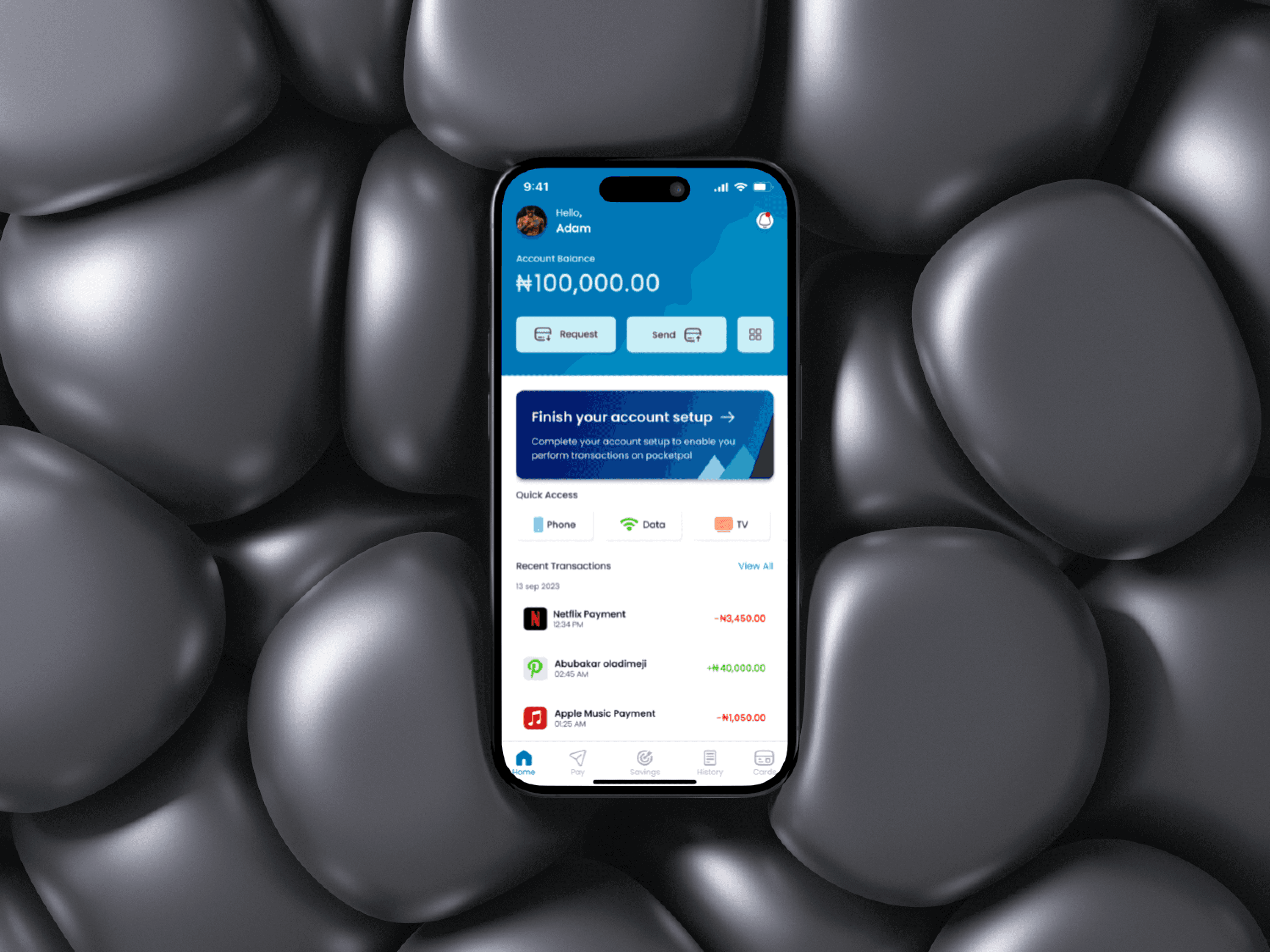

Design Screens

Design Screens